The 2025 NASCAR Cup Series season marks a significant milestone, ushering in a decade of operation under the charter system. This year also signifies the commencement of the second iteration of the charter agreement, an extension of the initial framework established for the 2016 season. However, the current season’s narrative is overshadowed by a high-profile lawsuit filed by two teams, alleging federal antitrust violations against the sanctioning body, stemming directly from the recent charter agreement extension negotiations.

At its core, the ownership charter system grants specific entries guaranteed starting positions in every Cup Series race, coupled with a defined revenue stream derived from negotiated terms. The initial agreement, aligned with the sport’s television rights deals, spanned from 2016 to 2024. The newly ratified agreement extends this framework from 2025 to 2031, mirroring the upcoming broadcast rights cycle. In return for these guaranteed benefits, charter holders are obligated to participate in agreed-upon marketing initiatives and permit NASCAR to leverage their intellectual property for promotional purposes.

While this simplified explanation captures the essence, the system’s implications run deeper. Many teams have increasingly viewed these charters as akin to franchises in traditional stick-and-ball sports, such as the New England Patriots or Los Angeles Dodgers. The concept is that each car number represents a distinct professional entity. However, a key distinction, and a contributing factor to the ongoing legal disputes, is that the NASCAR Cup Series, unlike many professional sports leagues, does not operate as an equal partnership between the sanctioning body and its teams.

Currently, 36 ownership charters are in circulation within NASCAR, each bestowing a set of shared advantages under the Cup Series umbrella. The most crucial of these is the guaranteed entry into every race, irrespective of the number of non-chartered entries attempting to qualify on any given weekend. Similar to revenue sharing models in other sports, teams with charters benefit from a portion of the overall revenue generated through television contracts and licensing agreements, as stipulated by the charter agreement.

Related News :

- 2026 NASCAR Season Broadcast Details Unveiled, Featuring Expanded Network Coverage and New Time Slots

- NASCAR Unveils Comprehensive 2026 Broadcast Schedule and Start Times Across All Three National Series

- Larson Claims Second NASCAR Cup Title in Overtime Thriller, Hamlin’s Championship Dreams Shattered

- Seven-Time Champion Jimmie Johnson Set for Historic Return to San Diego on Inaugural NASCAR Street Course

- Greg Biffle Leverages Aerial Skills and Logistics Expertise to Aid Hurricane Melissa Survivors in the Caribbean

It is imperative to understand that the value of these 36 charters is not uniform. A charter’s worth is intrinsically linked to the performance of its associated car over the preceding two seasons. The financial distribution at the end of each year is determined by a formula that factors in both the charter’s calculated value and the team’s final standing in the championship.

Beyond the financial and competitive assurances, the charter system also provides a voice in decision-making processes. This element functions analogously to the Concorde Agreement in Formula 1, fostering a degree of dialogue between NASCAR and its teams on matters pertaining to competition.

A significant portion of the teams operate collectively under the umbrella of the Race Team Alliance (RTA). This union-like entity has established its own media arm, Racing America, and fields a negotiating committee that engages with NASCAR on crucial business-related matters. The maximum field size for a NASCAR Cup Series race is capped at 40 cars. This means that while up to four non-chartered entries can still compete, they receive substantially less purse money compared to their chartered counterparts.

The inception of the charter system was deliberately designed to cultivate an economic ecosystem, thereby creating demand for charters and, consequently, their value. From its outset, NASCAR and the RTA aimed to establish a model that would generate long-term value for team ownership and simultaneously incentivize competition for charter acquisition. The underlying principle was that if a charter held intrinsic value, it would also possess a tangible worth upon resale. In prior eras of NASCAR, when a Cup Series team ceased operations, the residual assets were often limited to physical infrastructure, with race cars and equipment rapidly depreciating and being sold for a fraction of their initial cost. The escalating value of ownership charters has thus fostered a dynamic of supply and demand in the open market.

Further contributing to the long-term economic stability is the Next Gen car, now in its fourth season of competition. Although its cost-containment goals are still being fully realized, the car is designed as a de facto spec vehicle, with standardized components except for engines and body shells. The working theory posits that as parts inventory matures and becomes more standardized, teams will eventually realize significant cost savings. If the Next Gen car ultimately achieves its objective of reducing competition costs, and if the forthcoming broadcast rights agreement yields increased revenue opportunities, teams may find themselves less dependent on sponsorship income for their financial viability. This, at least, is the overarching concept.

Each ownership charter possesses the flexibility to be leased to another organization for a single season within an agreement period, provided it is returned to its original owner at the conclusion of that season. The initial charter agreement was in effect from 2016 to 2020. The current agreement, which began in 2021, is synchronized with the current television broadcast rights held by FOX and NBC, and concludes in 2024. The subsequent broadcast rights agreement, scheduled from 2025 to 2031, is notable for expanding the broadcast partners to include FOX, NBC, TNT, and Amazon Prime.

The full documentation of the current charter agreement is available for public review. While there are currently 36 charters in play, NASCAR retains the discretion to alter this number, with corresponding adjustments to payout structures. Since the charter agreement’s inception, numerous charters have been bought and sold, illustrating the dynamic nature of this economic model. The following provides a detailed historical overview of each ownership charter entering the 2025 season.

Trackhouse Racing – No. 1: This charter, currently owned by Trackhouse Racing and associated with Ross Chastain, originated with Chip Ganassi Racing in 2016. It was driven by Jamie McMurray and later Kurt Busch before Trackhouse acquired Ganassi’s NASCAR assets after the 2021 season, reassigning Chastain from the No. 42 to this chartered entry.

Team Penske – No. 2: Aligned with the No. 2 car driven by Austin Cindric, this charter has consistently belonged to Team Penske. It was driven by Brad Keselowski when awarded and remained with the No. 2 upon Cindric’s transition to the Cup Series.

Richard Childress Racing – No. 3: This charter has been perpetually linked to Richard Childress Racing and the No. 3 car, driven by Austin Dillon since its inception.

Front Row Motorsports – No. 4: This charter’s recent history includes its association with the No. 4 car at Stewart-Haas Racing, driven by Kevin Harvick and later Josh Berry. It was sold to Front Row Motorsports in 2024, though the transaction faced legal hurdles due to an antitrust lawsuit filed by the team against NASCAR.

Hendrick Motorsports – No. 24: Initially awarded to Hendrick Motorsports as the No. 5 car driven by Kasey Kahne in 2016, this charter transitioned to the No. 24 when William Byron graduated to the Cup Series in 2018.

Team Penske – No. 12: This charter’s lineage traces back to Roush Fenway Racing’s No. 6 car in 2016. It later became the No. 37 when leased to JTG Daugherty Racing with Chris Buescher. Upon its return to Roush Fenway, it was acquired by Team Penske to establish their third entry for Ryan Blaney.

Kaulig Racing – No. 16: Awarded to Tommy Baldwin Racing in 2016 as the No. 7, this charter has seen multiple ownership changes, including Leavine Family Racing and Spire Motorsports, before its acquisition by Kaulig Racing prior to the 2022 season.

Legacy Motor Club – No. 42: This charter began with Richard Petty Motorsports as the No. 9. It underwent several renumberings and leases, including to GoFas Racing and Rick Ware Racing, before becoming part of Petty GMS Racing and subsequently Legacy Motor Club.

23XI Racing – No. 35: This charter was originally associated with Stewart-Haas Racing’s No. 10 car, driven by Danica Patrick, Aric Almirola, and Noah Gragson. Its transfer to 23XI Racing in 2024 was also subject to legal challenges stemming from the antitrust lawsuit.

Joe Gibbs Racing – No. 11: This charter has been a constant with Joe Gibbs Racing and the No. 11 car, driven by Denny Hamlin throughout its tenure.

23XI Racing – No. 23: This charter was owned by Germain Racing for its No. 13 car before being sold to 23XI Racing in 2021. Its chartered status is currently under legal review due to the ongoing antitrust litigation.

Trackhouse Racing – No. 88: This charter’s history is tied to Stewart-Haas Racing, initially as the No. 14 driven by Tony Stewart, Clint Bowyer, and Chase Briscoe. It was sold to Trackhouse Racing ahead of Stewart-Haas’s closure.

Haas Factory Team – No. 41: Originally awarded to Michael Waltrip Racing and immediately sold to Stewart-Haas Racing, this charter has been consistently linked to the No. 41. It transitioned to Haas Factory Team following Stewart-Haas Racing’s downsizing.

RFK Racing – No. 6: What is now the RFK Racing No. 6 charter began as Roush Fenway Racing’s No. 16. It was renumbered and has remained with the team, even after Brad Keselowski joined as an owner-driver.

RFK Racing – No. 17: This charter has been a fixture with Roush Fenway Racing since its inception, consistently associated with the No. 17 car.

Joe Gibbs Racing – No. 54: This charter originated as Joe Gibbs Racing’s No. 18, driven by Kyle Busch. It was renumbered to the No. 54 when Ty Gibbs joined the team.

Joe Gibbs Racing – No. 20: This charter has remained with Joe Gibbs Racing and the No. 20 car, having been driven by drivers including Matt Kenseth, Erik Jones, and currently Christopher Bell.

Team Penske – No. 22: This charter has been consistently aligned with Team Penske and the No. 22 car, driven by Joey Logano.

Spire Motorsports – No. 7: This charter’s history is complex, starting with BK Racing and undergoing multiple ownership changes and leases, including to Front Row Motorsports and Rick Ware Racing, before its acquisition by Spire Motorsports.

Hendrick Motorsports – No. 9: Initially awarded to Hendrick Motorsports as the No. 24, this charter became the No. 9 when William Byron moved to the No. 24 in 2018, with Chase Elliott continuing as its driver.

23XI Racing – No. 45: This charter originated from Richard Childress Racing’s No. 27 and was subsequently leased and sold to StarCom Racing before its acquisition by 23XI Racing. Its chartered status is currently under review due to the antitrust litigation.

Richard Childress Racing – No. 8: This charter began as Richard Childress Racing’s No. 31. It transitioned to the No. 8 in 2019 and has since been driven by Daniel Hemric, Tyler Reddick, and currently Kyle Busch.

Wood Brothers Racing – No. 21: This charter’s lineage traces back to GoFas Racing’s No. 32, which was leased and then sold to Wood Brothers Racing. After several drivers, Josh Berry is set to pilot the car in 2025.

Spire Motorsports – No. 71: This charter possesses the most intricate ownership history, starting with Circle Sport Racing and involving multiple partnerships and sales before its current ownership by Spire Motorsports. Michael McDowell returns to a charter he previously raced under.

Front Row Motorsports – No. 34: This charter has remained with Front Row Motorsports since its inception, consistently associated with the No. 34 car. Its status is currently impacted by the antitrust lawsuit filed by the team.

Rick Ware Racing – No. 51: Originally awarded to Front Row Motorsports as the No. 38, this charter was sold to Rick Ware Racing in 2019 and has seen numerous number changes to maintain its chartered status.

Trackhouse Racing – No. 99: This charter began with Chip Ganassi Racing as the No. 42 and was acquired by Trackhouse Racing in 2021, subsequently being renumbered to the No. 99 for Daniel Suarez.

Legacy Motor Club – No. 43: This charter originated as Richard Petty Motorsports’ No. 43. It has undergone ownership changes, including with Rick Ware Racing and Petty GMS Racing, before becoming Legacy Motor Club’s No. 43, driven by Erik Jones.

HYAK Racing – No. 47: This charter has been with JTG-Daugherty Racing since its inception as the No. 47, driven by various drivers including AJ Allmendinger and Ricky Stenhouse Jr. It will compete as HYAK Racing in 2025.

Hendrick Motorsports – No. 5: This charter began as Hendrick Motorsports’ No. 48, driven by Jimmie Johnson. It transitioned to the No. 5 upon Johnson’s retirement, with Kyle Larson as the current driver. Alex Bowman now pilots the No. 48, which is essentially a rebranded No. 88.

RFK Racing – No. 60: This charter’s history includes HScott Motorsports, Premium Motorsports, and Rick Ware Racing before being leased to RFK Racing for Ryan Preece in 2025.

Joe Gibbs Racing – No. 19: Awarded to Michael Waltrip Racing and immediately sold to Joe Gibbs Racing, this charter has been associated with the No. 19 and driven by Carl Edwards, Daniel Suarez, and Martin Truex Jr., with Chase Briscoe set to take over in 2025.

Spire Motorsports – No. 77: This charter began as Premium Motorsports’ No. 62, undergoing leases and sales before its acquisition by Spire Motorsports. Carson Hocevar has been the driver since 2024.

Kaulig Racing – No. 10: Originally Furniture Row Racing’s No. 78, this charter was sold to Spire Motorsports and then Kaulig Racing. It has been associated with the No. 31 and will be the No. 10 with Ty Dillon in 2025.

Front Row Motorsports – No. 38: This charter originated with BK Racing and was sold to Front Row Motorsports in 2018, where it has remained. Its status is currently affected by the antitrust lawsuit.

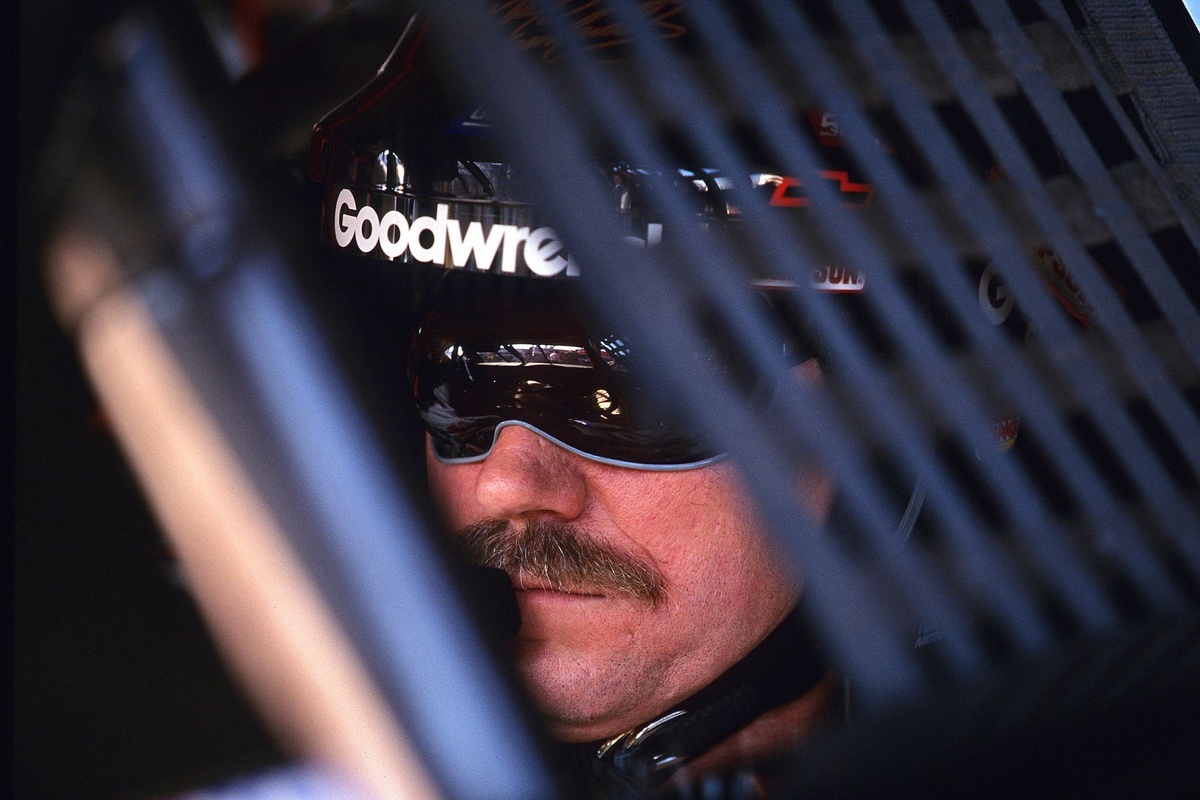

Hendrick Motorsports – No. 48: This charter began as Hendrick Motorsports’ No. 88, driven by Dale Earnhardt Jr. and Alex Bowman. It became the No. 48 upon Jimmie Johnson’s retirement.

💬 Tinggalkan Komentar dengan Facebook

Author Profile

Latest entries

Nascar CupFebruary 22, 2026Daytona 500 Start Time Advanced by One Hour Amidst Threat of Severe Thunderstorms

Nascar CupFebruary 22, 2026Daytona 500 Start Time Advanced by One Hour Amidst Threat of Severe Thunderstorms Nascar CupFebruary 22, 2026Ryan Preece Tops Final Daytona 500 Practice Amidst Handling Worries

Nascar CupFebruary 22, 2026Ryan Preece Tops Final Daytona 500 Practice Amidst Handling Worries Nascar CupFebruary 22, 2026A Quarter-Century Later, NASCAR Still Grapples with the Shadow of Daytona’s Darkest Day

Nascar CupFebruary 22, 2026A Quarter-Century Later, NASCAR Still Grapples with the Shadow of Daytona’s Darkest Day Nascar CupFebruary 22, 2026Gaston County Fire Services Concludes Hamlin Family Residence Blaze Accidental, Origin Remains Elusive

Nascar CupFebruary 22, 2026Gaston County Fire Services Concludes Hamlin Family Residence Blaze Accidental, Origin Remains Elusive