A seismic legal battle is set to redefine the landscape of premier stock car racing in North America, as 23XI Racing and Front Row Motorsports prepare to face NASCAR in an antitrust trial. The proceedings, slated to commence imminently, carry the potential to fundamentally alter the business and competitive structure of the Cup Series. The stakes are exceptionally high, with the plaintiffs alleging anti-competitive practices by NASCAR, a claim the sanctioning body vehemently denies.

The core of the dispute lies in the interpretation and application of NASCAR’s charter agreement, a document that governs the commercial and competitive relationship between the league and its elite teams. 23XI Racing, co-owned by basketball legend Michael Jordan, alongside driver Denny Hamlin and long-time associate Curtis Polk, and Front Row Motorsports initiated legal action on October 2, 2024, in the Western District of North Carolina. Their lawsuit asserts that NASCAR has engaged in monopolistic behavior to consolidate its power and control over the sport’s top-tier teams.

At the heart of their argument is the concept of monopsony, a market condition where there is only a single buyer. In this context, the plaintiffs contend that NASCAR functions as a "buyer’s monopolist," dictating terms to premier stock car teams, who are essentially the service providers. The lawsuit specifically targets contractual restrictions within the charter agreement, including non-compete clauses for both teams and racetracks, which 23XI and Front Row argue stifle competition.

A particular point of contention is Section 13 of the charter agreement, which contains a "no-sue" provision. The plaintiffs maintain this clause is a violation of the Sherman Antitrust Act, a cornerstone of U.S. antitrust law designed to prevent monopolies and promote fair competition. Additionally, Section 6, a non-compete clause designed to prevent teams from participating in rival racing series, is under scrutiny, despite NASCAR outlining exceptions for entities like Formula 1, IndyCar, World of Outlaws, and CARS Tour. Lead attorney for 23XI and Front Row, Jeffrey Kessler, argues that these measures are deliberately designed to suppress revenue for teams and prevent them from exploring alternative commercial opportunities.

Related News :

- Denny Hamlin Commits to NASCAR Cup Series Through 2026, Reflects on Phoenix Heartbreak and Personal Challenges

- NASCAR Antitrust Trial Commences with Opening Statements and Initial Witness Testimony

- Seven-Time Champion Jimmie Johnson Set for Historic Return to San Diego on Inaugural NASCAR Street Course

- Antitrust Trial Kicks Off as NASCAR Faces Allegations of Monopoly Power

- NASCAR’s Charter System Poised for Franchise Evolution Following Landmark Settlement, Dale Earnhardt Jr. Observes

The plaintiffs also point to NASCAR’s acquisition of the ARCA Racing Series and its merger with track-owning subsidiary International Speedway Corporation as strategic moves aimed at solidifying its monopsonistic position. Furthermore, the introduction of the fourth-generation NextGen car has drawn criticism, with the teams alleging that NASCAR exerts control over base costs through a single-source supply system for components, forcing teams to purchase from NASCAR-approved vendors.

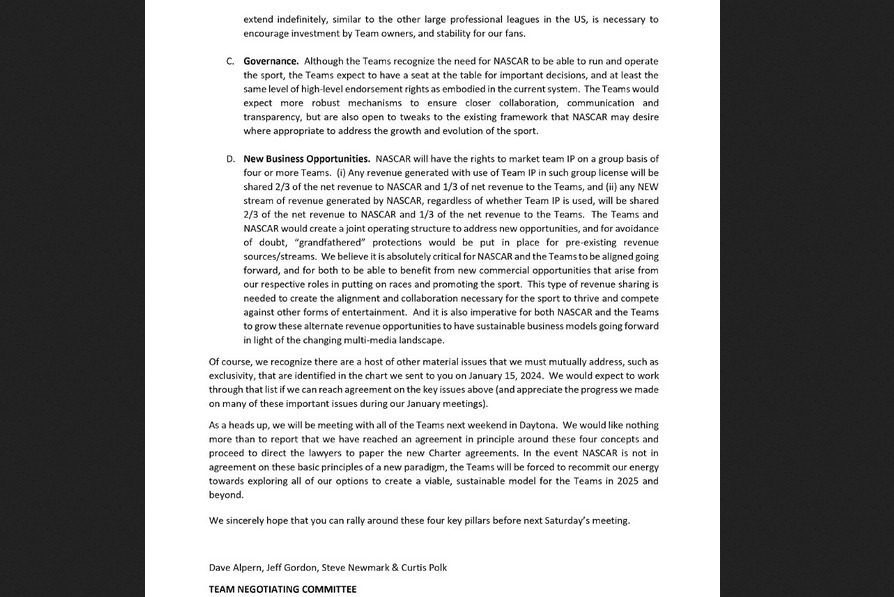

This legal showdown stems from the refusal of 23XI Racing and Front Row Motorsports to sign the latest charter agreement extension. This decision followed nearly three years of arduous and often contentious negotiations between NASCAR and its teams. The charter system, established in 2016, has been the framework for the Cup Series’ business operations and competitive structure.

The extensive fact discovery process in preparation for the trial has unearthed significant animosity and frustration between the involved parties. Much of the negotiation’s discord, as revealed through discovery, centered on financial matters, specifically the percentage of revenue charter-holding teams would receive following NASCAR’s new broadcast rights agreements with FOX, NBC, Turner Sports, and Amazon Prime. Beyond revenue sharing, teams also sought permanent charter status, moving away from the seven-year renegotiation cycle, and sought greater clarity on intellectual property rights and governance.

NASCAR claims that the recently ratified charter agreement for 2025-2031 represents a 62% increase in revenue for teams, derived entirely from new broadcast rights deals. The sanctioning body also asserts that $50 million previously allocated to tracks has been redirected to teams under the new agreement. However, 23XI and Front Row counter that the effective annual increase over the 15-year period from 2016 to 2031 is a more modest 3-4%. Their refusal to accept these terms directly precipitated the lawsuit.

NASCAR’s defense, spearheaded by lead attorney Christopher Yates, centers on the assertion that 23XI and Front Row have not acted in good faith, framing the lawsuit as an attempt at "negotiation through litigation" after failing to secure their desired charter terms. The sanctioning body argues it has not violated antitrust laws, as evidenced by the increased enterprise value of owning Cup Series teams since the charter system’s inception. NASCAR points to a significant rise in the value of a single charter entry, from approximately $1 million to upwards of $50 million in recent transactions. This valuation, NASCAR contends, is a direct result of leadership efforts to enhance the value for charter holders, a premise that also enticed Michael Jordan’s investment.

NASCAR further plans to argue that 23XI and Front Row have previously accepted the terms they now deem anti-competitive. Both teams have acquired charters from other organizations over the past decade without raising objections to the disputed clauses until the conclusion of the recent negotiations. The league is also expected to defend exclusivity and non-compete provisions as standard and legal business practices within professional sports, crucial for effective marketing and fan engagement.

Efforts to resolve the dispute outside of court have thus far proven unsuccessful. Settlement mediation sessions, mandated by the court, took place in New York City on August 5, 2025, with former NBA Chief Legal Officer Jeffrey as mediator. This initial meeting, lasting approximately an hour, yielded no progress. A subsequent court-mandated mediation session in October, described by Judge Kenneth D. Bell as conducted "in good faith," also failed to produce an agreement, reportedly breaking down over the allocation of legal fees, though some common ground on charter permanency was reportedly found.

The trial, scheduled to begin with jury selection, is expected to run for 10 days over two weeks. The proceedings will not be broadcast, limiting reporting to handwritten notes from attendees. Both sides have submitted extensive documentation, with 23XI and Front Row filing 858 exhibits and NASCAR presenting 961. While witness lists remain private, they are anticipated to include team owners, executives, and industry experts. A unanimous decision from the six-member jury will be required for Judge Bell to issue a remedy. The burden of proof rests with 23XI and Front Row, who must convince the jury by a "preponderance of the evidence" – meaning it is more likely than not that their claims are true.

The plaintiffs are seeking over $300 million in damages, with the jury determining the final amount, capped by a four-year look-back period. Beyond financial compensation, Judge Bell retains the authority to implement significant antitrust remedies, including potentially forcing NASCAR to divest tracks, dismantle the single-source car supply system, eliminate exclusivity clauses, or fundamentally alter the charter system itself.

A crucial, though often underreported, aspect of a potential 23XI and Front Row victory is that it does not automatically guarantee the return of their charters. Both teams lost their chartered status following a preliminary injunction appeals decision earlier this year, and their damages claim includes the value of these lost charters. NASCAR’s legal position is that it cannot be compelled to do business with entities it chooses not to.

Judge Bell has previously indicated a willingness to examine the charter system’s legality. This has led the 13 non-party charter teams to submit affidavits urging a settlement to avoid a ruling that could render their investments obsolete.

Should NASCAR prevail, 23XI and Front Row, without charters, face the real possibility of ceasing operations and exiting the Cup Series by the end of the 2026 season. NASCAR could then potentially sell the six disputed charters, which had already garnered interest from other parties before Judge Bell ordered a hold on their sale pending the trial’s outcome.

The trial’s verdict is unlikely to be the final chapter. The losing party is expected to appeal to the Fourth District Court of Appeals in Richmond, Virginia, with the possibility of further appeal to the United States Supreme Court. This legal entanglement also includes a dismissed counterclaim by NASCAR against 23XI, Front Row, and Curtis Polk, accusing them of anti-competitive cartel behavior.

Ultimately, while the trial marks a critical juncture, it may not signify the end of this protracted legal saga. As Judge Bell himself cautioned, the "house" of NASCAR racing is at risk if a settlement isn’t reached, underscoring the profound implications of the upcoming proceedings for the sport.

💬 Tinggalkan Komentar dengan Facebook

Author Profile

Latest entries

Nascar CupMarch 9, 2026Blaney Masters Mayhem in Phoenix, Securing Penske Sweep Amidst Record-Tying Caution Barrage

Nascar CupMarch 9, 2026Blaney Masters Mayhem in Phoenix, Securing Penske Sweep Amidst Record-Tying Caution Barrage Nascar CupMarch 9, 2026Joey Logano Assesses Blame for Phoenix Pileup After Challenging Day

Nascar CupMarch 9, 2026Joey Logano Assesses Blame for Phoenix Pileup After Challenging Day Nascar CupMarch 9, 2026Blaney Masters Phoenix, Signaling a Resurgent NASCAR Package

Nascar CupMarch 9, 2026Blaney Masters Phoenix, Signaling a Resurgent NASCAR Package Nascar CupMarch 9, 2026Blaney Ascends to Second as Reddick Maintains Points Lead After Phoenix Cup Race

Nascar CupMarch 9, 2026Blaney Ascends to Second as Reddick Maintains Points Lead After Phoenix Cup Race