The Western District of North Carolina courtroom buzzed with anticipation Friday afternoon as basketball icon and 23XI Racing co-owner Michael Jordan took the stand, marking a pivotal moment in the ongoing antitrust lawsuit filed by 23XI Racing and Front Row Motorsports against NASCAR. The trial, which has captivated the motorsports world for over 15 months, reached its dramatic crescendo as Jordan, alongside Heather Gibbs, daughter-in-law of NASCAR Hall of Famer Joe Gibbs, presented their cases against the sanctioning body and its CEO, Jim France.

At the heart of the legal battle is the assertion by 23XI Racing and Front Row Motorsports that NASCAR operates as a monopsony – a buyer’s monopoly – in the market for premier stock car racing teams. The plaintiffs contend that NASCAR, as the sole purchaser of these elite racing entities, has leveraged its market power to suppress team earnings, particularly during the contentious charter extension negotiations. The jury’s task is to determine whether this alleged market power was wielded to the detriment of competition and team finances.

Michael Jordan, who co-founded 23XI Racing with Cup Series driver Denny Hamlin and longtime associate Curtis Polk, articulated his vision for a more equitable partnership within NASCAR. Drawing parallels to the National Basketball Association, where he achieved unparalleled success as both player and owner, Jordan advocated for a revenue-sharing model closer to 50-50 between the league and its teams, alongside a more collaborative approach to growth. "If you share responsibility, the healthiness of the sport can grow," Jordan testified. "It needed to be looked at from a whole different perspective. That’s why we’re here."

Jordan revealed his substantial investment in 23XI Racing, injecting $35 to $40 million into the team, despite initial reservations from his business manager, Curtis Polk, who cautioned about potential risks to Jordan’s brand and image. Polk, a central figure in NASCAR’s defense, was portrayed as an outsider with a purely business-driven agenda, even expressing disdain for the sport itself, stating races were "boring as shit." Evidence presented by NASCAR included texts from Polk suggesting a strategy to "be a pest and have a mosquito bite every week" during negotiations, including leaking financial proposals to the media. Jordan’s affirmative responses to these tactics, conveyed through thumbs-up emojis, were highlighted by NASCAR’s defense.

Related News :

- NASCAR Unveils Comprehensive 2026 Broadcast Schedule and Race Timings Across All Series

- Denny Hamlin Secures Phoenix Pole Position for NASCAR Cup Championship Showdown

- 23XI and Front Row Racing Narrow Antitrust Focus in NASCAR Legal Battle

- Legal Battle Intensifies: NASCAR Seeks Exclusion of Key 23XI Racing Owners from Antitrust Trial

- Chase Elliott’s No. 9 Chevrolet to Feature Refreshed NAPA Auto Parts Livery for 2026 NASCAR Season

Despite these contentious exchanges, Jordan maintained that he is a lifelong NASCAR fan and that his investment was driven by a desire to win championships. He acknowledged the increasing cost of acquiring charters, with the third charter costing $28 million, compared to $13.5 million for the second and a mere $4.7 million for the first. Jordan’s justification for these escalating purchases was simple: "people who know me know I like to win and I will pursue anything to win and getting a third charter improves our chance to win the championship." While his team has achieved profitability, Jordan insists the current charter system’s structure is inherently unfair, having entered NASCAR with optimism only to find its economic model "unfair" as he gained deeper understanding.

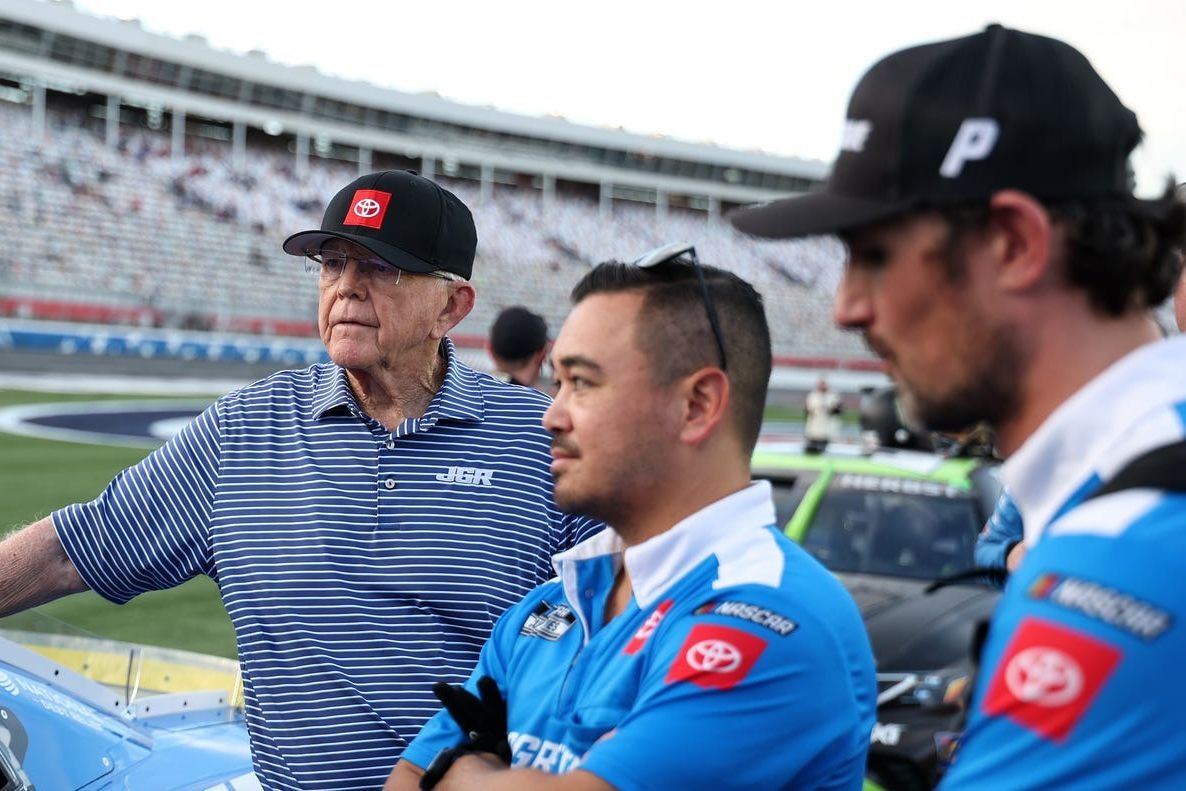

In contrast to Jordan’s more forward-looking perspective, Heather Gibbs’ testimony offered a deeply personal and emotional account of the challenges faced by family-owned race teams. Gibbs spoke candidly about the recent passing of her husband, Coy Gibbs, son of Joe Gibbs, in November 2022, just hours after their son Ty secured an Xfinity Series championship. This profound personal loss has galvanized Heather’s involvement in the day-to-day operations of Joe Gibbs Racing and, crucially, in the charter negotiations.

Gibbs described the financial realities of the Cup Series as "very challenging for the teams," particularly for an organization like Joe Gibbs Racing, which relies solely on its racing operations for revenue. She recounted a fiery letter she penned to NASCAR leadership in response to commissioner Steve Phelps’ assertion that team spending was "reckless," a comment that deeply bothered her. Despite her respect for the France family, Gibbs detailed the immense pressure surrounding the charter extension deadline. She characterized the ultimatum as a "gun to the head" proposition, with the final agreement, riddled with grammatical errors, presented at 5 p.m. with a signing deadline of 6 p.m. on September 6th.

Gibbs revealed that Joe Gibbs had pleaded with Jim France, saying, "don’t do this to us." However, when she raised concerns about the agreement, particularly the lack of guaranteed broadcast revenue beyond the initial seven years, France’s response was reportedly, "I’m done with the conversation" and "If I wake up and I have 20 charters, I have 20 charters." Ultimately, Heather signed the agreement, driven by a desire to honor the legacy of Coy and JD Gibbs and the fear of losing any agreement altogether.

NASCAR’s defense, led by attorney Lawrence Buterman, countered by emphasizing that the organization is privately owned and distinct from the team-owned leagues of stick-and-ball sports. Buterman argued that NASCAR’s structure allows for strategic decisions that benefit the entire ecosystem. The defense also highlighted the significant increase in charter values, from $1 million in 2016 to $45 million in the past season, as evidence of the sport’s robust health and attractiveness to private equity. NASCAR President Steve O’Donnell, who spent nearly five hours on the stand, reiterated this point, stating, "It shows that people believe in the sport."

O’Donnell addressed concerns about potential competition, particularly the Superstar Racing Experience (SRX), asserting that the existence of over 1,000 tracks in the U.S. limits NASCAR’s ability to monopolize racing venues. He noted that only 30 tracks have exclusivity clauses with NASCAR. O’Donnell also touched upon the proposed cost cap and cost floor for the 2025 season, indicating that while some dominant teams might be hesitant, middle-tier teams are more receptive to the idea, citing Formula 1’s successful implementation of a cost cap.

The "four pillars" proposal from the teams, which sought $20 million per chartered entry, was met with shock by O’Donnell, who stated it would leave insufficient revenue for tracks and hinder overall industry growth. He pointed to IndyCar teams receiving approximately 25% of revenue, translating to $2-2.5 million per car, a figure contested by the plaintiff’s counsel, who argued it was closer to $8 million per entry.

Throughout the proceedings, the jury has been presented with competing narratives: one of an entrenched monopoly stifling innovation and team earnings, and the other of a complex business navigating a dynamic landscape while striving for overall industry growth. The trial’s conclusion, originally slated for two weeks, is now projected to extend into mid-December, underscoring the intricate nature of the legal and business intricacies at play. Judge Kenneth D. Bell has cautioned both sides to expedite proceedings, acknowledging the burden on the jury, while also noting that "growing the sport" is not a viable defense, as it can be interpreted as an admission of seeking to increase NASCAR’s own revenues. The coming days will be crucial in determining the future operational framework of NASCAR and the economic landscape for its race teams.

💬 Tinggalkan Komentar dengan Facebook

Author Profile

Latest entries

Nascar CupMarch 9, 2026Joe Gibbs Racing Pursues Evidence of Alleged Trade Secret Conspiracy Between Spire Motorsports and Former Director

Nascar CupMarch 9, 2026Joe Gibbs Racing Pursues Evidence of Alleged Trade Secret Conspiracy Between Spire Motorsports and Former Director Nascar CupMarch 9, 2026Blaney Claims Phoenix Victory Amidst Chaotic Cup Series Encounter

Nascar CupMarch 9, 2026Blaney Claims Phoenix Victory Amidst Chaotic Cup Series Encounter Nascar CupMarch 9, 2026Blaney Masters Mayhem in Phoenix, Securing Penske Sweep Amidst Record-Tying Caution Barrage

Nascar CupMarch 9, 2026Blaney Masters Mayhem in Phoenix, Securing Penske Sweep Amidst Record-Tying Caution Barrage Nascar CupMarch 9, 2026Joey Logano Assesses Blame for Phoenix Pileup After Challenging Day

Nascar CupMarch 9, 2026Joey Logano Assesses Blame for Phoenix Pileup After Challenging Day