In a pivotal ruling that could reshape the landscape of professional stock car racing, a federal judge has sided with two prominent NASCAR Cup Series teams, 23XI Racing and Front Row Motorsports, in a critical antitrust lawsuit. The decision, handed down Tuesday by Judge Kenneth D. Bell overseeing the 23XI Racing and Front Row Motorsports v. NASCAR case, addresses the definition of the relevant market in the ongoing legal battle. This marks the second significant setback for NASCAR within as many weeks, following Judge Bell’s dismissal of the sanctioning body’s counterclaims last week.

Summary judgment, a pretrial ruling where a judge decides a case based on presented evidence without a jury, was the procedural vehicle for Tuesday’s decision. Judge Bell’s ruling defines the relevant market as "premiere Stock Car racing" and asserts that NASCAR operates as the sole purchaser of the services provided by such racing teams. This determination is a crucial victory for the plaintiffs, as it establishes a foundation for their claims of anticompetitive practices.

The judge’s decision hinged on what he described as NASCAR’s "contradictory positions" throughout the legal proceedings. NASCAR had previously argued that teams could pursue opportunities in other motorsports like Formula 1 or IndyCar if they disagreed with charter terms. However, in defending against the antitrust claims, NASCAR simultaneously contended that it was the only viable destination for these premier stock car racing teams, a stance necessary to underpin its accusations of an anticompetitive conspiracy led by 23XI investor Curtis Polk.

Judge Bell’s written order highlighted this inconsistency, stating, "In the Counterclaim, which alleged that the Teams unlawfully conspired in selling their racing services, NASCAR ‘deliberate[ly], clear[ly] and unambiguous[ly]’ alleged that the relevant market is ‘the market for entry of cars into NASCAR Cup Series races in the United States and any other location where a Cup Series race is held.’ This is effectively the same as the relevant market alleged by Plaintiffs – the ‘input market for premier stock car racing teams.’ The same transaction – the sale and purchase of premier stock car racing services – cannot be a different relevant market depending only on which side is complaining." The judge concluded, "Most simply put, NASCAR made a strategic decision in asserting its Counterclaim and must now live with the consequences."

Related News :

- Denny Hamlin Secures Coveted Pole Position for NASCAR Cup Series Championship Decider at Phoenix

- Phoenix Raceway Puzzled by Widespread NASCAR Cup Tire Failures

- Seven-time NASCAR Cup Series champion Jimmie Johnson Set to Compete in Historic San Diego Street Race

- Full 2025 NASCAR Charter Agreement Details Emerge Following Legal Ruling

- NASCAR’s 2025 Season Delivers Thrilling Photo Finishes, Truck Series Claims Closest Contest

This legal principle, known as judicial estoppel, prevents a party from asserting a position in a legal proceeding that is contrary to a position previously taken. 23XI and Front Row had urged Judge Bell to consider that NASCAR had effectively estopped itself, and the judge’s ruling validated their argument.

Further elaborating on NASCAR’s inconsistent stances, Judge Bell noted, "NASCAR argues that the relevant market that it alleges for its Counterclaim – in nearly the same words as Plaintiff describes their relevant market – is somehow not the same market. A simple example should suffice to show why NASCAR can’t play the same hand twice in different ways." He pointed out that NASCAR had previously argued that teams could not reasonably substitute IndyCar or Formula 1 teams, or even teams from NASCAR’s lower-tier series, to participate in the Cup Series. However, when opposing the plaintiffs’ market definition, NASCAR then argued that these same motorsports were readily available substitutes for Cup Series teams to sell their services. Judge Bell found this illogical and unsupported by evidence, emphasizing that there was no record evidence suggesting that racing teams could only move from NASCAR to other motorsports, but not vice versa.

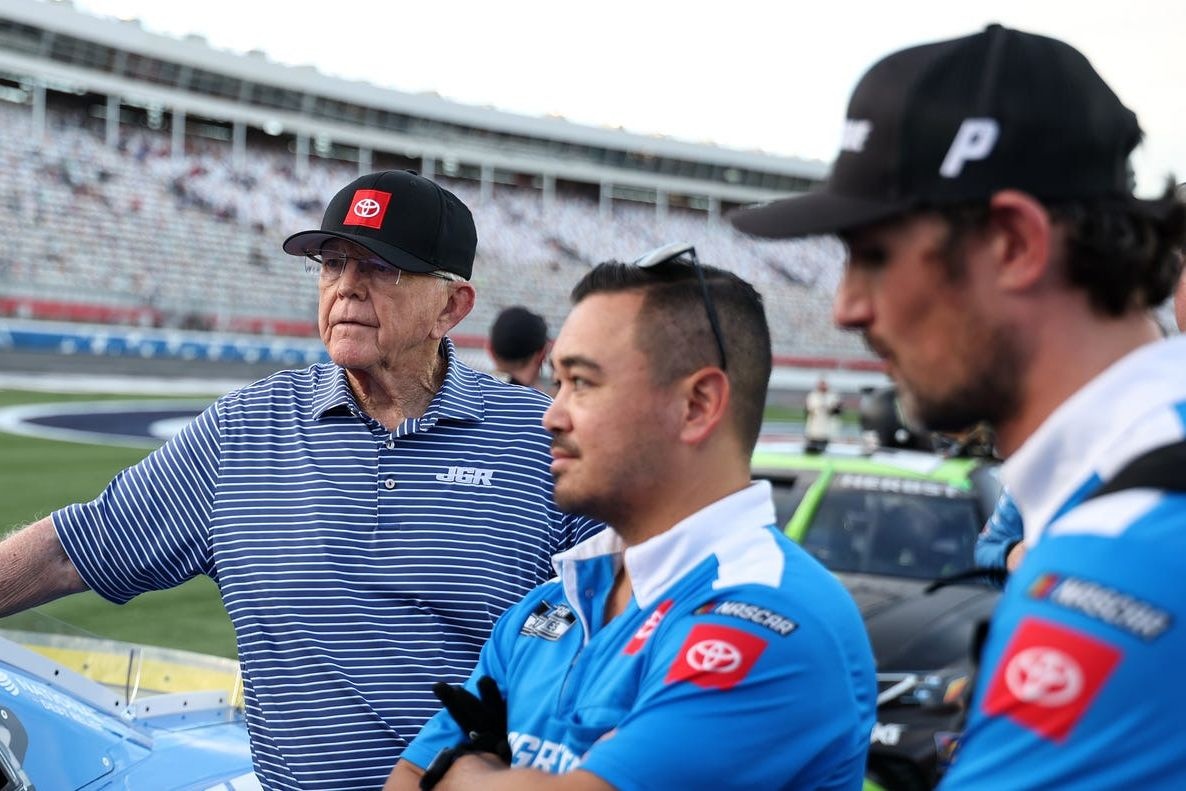

The judge also cited sworn testimony from NASCAR executives and experts who, when questioned about alternative purchasers of premier stock car racing team services, could not identify any. Jim France, Chairman of NASCAR, stated he "don’t know" when asked about comparable stock car racing series in the United States. Similarly, Steve Phelps, President of NASCAR, could not identify any stock car racing series that is a close competitor to NASCAR based on economic metrics like prize money, television ratings, or attendance.

Based on this testimony, Judge Bell concluded that NASCAR effectively holds a "100% market share" in the relevant market and has maintained this dominance for decades, a fact acknowledged by experts on both sides of the litigation.

The implications of this ruling are substantial. The upcoming trial, originally scheduled to begin on December 1, will now be narrowly focused on a single question: whether NASCAR exploited its unique market position as the sole buyer of "premiere Stock Car racing teams" to impose below-market terms on teams during negotiations for the extension of the Charter agreement. This agreement, in place since 2016, has significantly influenced the economic structure of the sport.

"In sum, NASCAR plainly exercises monopsony power in the relevant market under the governing analysis," Judge Bell wrote. He explained that not only has NASCAR operated the only premier stock car racing series in the United States for many years, but the barriers to entry for competitors—such as the availability of large racing tracks and highly qualified racing car teams—are also significant. Consequently, the judge ruled that the plaintiffs are entitled to summary judgment establishing NASCAR’s monopsony power as partial support for their Section 2 Sherman Act claim. Furthermore, the establishment of monopsony power also leads to a finding that NASCAR possesses market power for the purposes of the plaintiffs’ Section 1 claim, which requires a lower market share threshold than is needed to infer monopoly power.

A monopsony, in economic terms, describes a market situation where there is only one buyer for a particular good or service, allowing that buyer to impose below-market prices on sellers who have no alternative outlets. Judge Bell’s ruling that NASCAR is the exclusive buyer of premier stock car race teams directly supports this assertion.

NASCAR had attempted to counter the monopsony argument by claiming that it had increased revenue for teams through the Charter agreement extensions. However, Judge Bell rejected this defense, partly because NASCAR presented the final Charter terms as a "take it or leave it" offer after two years of negotiations. The judge noted, "with full control over the limited duration Charters necessary to be an economically viable Cup Series racing team, NASCAR indisputably had the power to decrease demand by denying Charters to any team that did not agree to its final Charter terms." He added that the fact that NASCAR "only had to use that power against the Plaintiffs doesn’t mean that it lacks monopsony power." Moreover, the inquiry is whether NASCAR had the power to suppress team payments below competitive levels, and simply stating that payments "increased" without comparing them to a competitive market level is insufficient proof.

The judge also dismissed NASCAR’s argument that the existence of other sports for investment or viewership negates its monopsony control. He stated, "Of course, Plaintiffs could exit the relevant market and fans could decide to seek entertainment elsewhere, but those options say nothing about NASCAR’s monopsony control of the relevant market."

A particularly significant aspect of Judge Bell’s ruling lies in a footnote that suggests the Charter agreements themselves may be anticompetitive. The judge indicated that there is evidence from which a jury or the court could conclude that the Charter agreements are "anticompetitive restraints on trade with respect to Cup Series aspirants who don’t have Charters." This implies that the current Charter system may be artificially inflating the barrier to entry for new teams wishing to compete in the Cup Series. This potential finding has reportedly caused concern among the 12 teams that have signed the new Charter agreements, who have previously submitted affidavits urging a settlement to avoid an outcome that could devalue the Charter system entirely.

Despite previous mediation attempts failing to yield a resolution, NASCAR reiterated its desire to settle the matter in a statement released following the ruling. However, the sanctioning body also expressed confidence in its position, stating, "NASCAR looks forward to proving that it became the leading motorsport in the United States through hard work, risk-taking, and many significant investments over the past 77 years. The antitrust laws encourage this—and NASCAR has done nothing anticompetitive in building the sport from the ground up since 1948. While we respect the Court’s decision, we believe it is legally flawed and we will address it at trial and in the Fourth Circuit if necessary. NASCAR believes in the charter system and will continue to defend it from 23XI and Front Row’s efforts to claim that the charter system itself is anticompetitive."

23XI Racing and Front Row Motorsports, through their lead attorney Jeffrey Kessler, expressed satisfaction with the ruling. "We are very pleased with the Court’s decision today, ruling in our favor," Kessler stated. "Not only does it deny NASCAR’s motion for summary judgment, but it also grants our partial summary judgment motion, finding that NASCAR has monopoly power in a properly defined market. This means that the trial can now be focused on whether NASCAR has maintained that power through anticompetitive acts and used that power to harm teams. We’re prepared to present our case to the jury and are focused on obtaining a verdict that benefits all of the teams, partners, drivers, and the fans."

The upcoming trial is now poised to determine the extent to which NASCAR has leveraged its market dominance and whether the Charter system, a cornerstone of the sport’s economic structure, is deemed an unlawful restraint on trade.

💬 Tinggalkan Komentar dengan Facebook

Author Profile

Latest entries

Nascar CupMarch 2, 2026Van Gisbergen Expresses Disappointment Despite Strong Second-Place Finish at COTA, Climbing to Fifth in Championship Standings

Nascar CupMarch 2, 2026Van Gisbergen Expresses Disappointment Despite Strong Second-Place Finish at COTA, Climbing to Fifth in Championship Standings Nascar CupMarch 2, 2026Joe Gibbs Racing Accuses Spire Motorsports and Chris Gabehart of Trade Secret Conspiracy in Legal Filing

Nascar CupMarch 2, 2026Joe Gibbs Racing Accuses Spire Motorsports and Chris Gabehart of Trade Secret Conspiracy in Legal Filing Nascar CupMarch 2, 2026Reddick Dominates COTA, Secures Commanding Early Championship Lead in NASCAR Cup Series

Nascar CupMarch 2, 2026Reddick Dominates COTA, Secures Commanding Early Championship Lead in NASCAR Cup Series Nascar CupMarch 2, 2026Reddick Achieves Historic Three-Peat, Echoing Jordan’s Dominance

Nascar CupMarch 2, 2026Reddick Achieves Historic Three-Peat, Echoing Jordan’s Dominance