A high-stakes antitrust trial involving NASCAR, 23XI Racing, and Front Row Motorsports is poised to commence, with potentially far-reaching implications for the future of premier stock car racing in North America. The legal battle, scheduled to begin with jury selection imminently, centers on allegations that NASCAR has engaged in anti-competitive practices to maintain a monopolistic grip on the sport’s top tier. The proceedings were foreshadowed by U.S. District Judge Kenneth D. Bell’s June 25 admonition to both parties, warning of potential fallout if a settlement isn’t reached before a final judgment. As the trial date approaches, the figurative "house" of NASCAR’s business model appears to be smoldering, with extensive pre-trial fact discovery revealing deep-seated animosity and frustration among those involved in the lucrative business of Cup Series competition.

The core of the legal dispute, filed on October 2, 2024, in the Western District of North Carolina, rests on the claim by 23XI Racing, co-owned by basketball icon Michael Jordan, alongside driver Denny Hamlin and longtime associate Curtis Polk, and Front Row Motorsports, that NASCAR has implemented contractual restrictions designed to suppress competition and consolidate its power. Specifically, the lawsuit targets Section 13 of the charter agreement, which includes a "no-sue" provision, and Section 6, a non-compete clause intended to prevent teams from participating in rival series. While NASCAR outlines exceptions for entities like Formula 1, IndyCar, World of Outlaws, and CARS Tour, 23XI and Front Row argue these clauses, coupled with other actions, unlawfully impede market competition and restrict revenue potential for teams.

Attorneys for 23XI and Front Row, led by prominent sports litigator Jeffrey Kessler, contend that NASCAR’s alleged anti-competitive conduct aims to artificially suppress the revenue teams receive while simultaneously preventing the emergence of alternative racing series capable of acquiring their services. The plaintiffs further assert that NASCAR’s strategic acquisitions, including the ARCA Racing Series, and its merger with track-owning affiliate International Speedway Corporation, were calculated moves to solidify its monopsonistic position. A monopsony, in economic terms, describes a market where there is only a single buyer for a particular service. In this context, the court has identified NASCAR as the "buyer’s monopolist" in the market for premier stock car racing teams, which provide the service of competition. The teams also take issue with the fourth-year Next Gen car platform, arguing that NASCAR’s control over its single-source supplied components, which can only be purchased through NASCAR-designated vendors, effectively dictates base costs for teams.

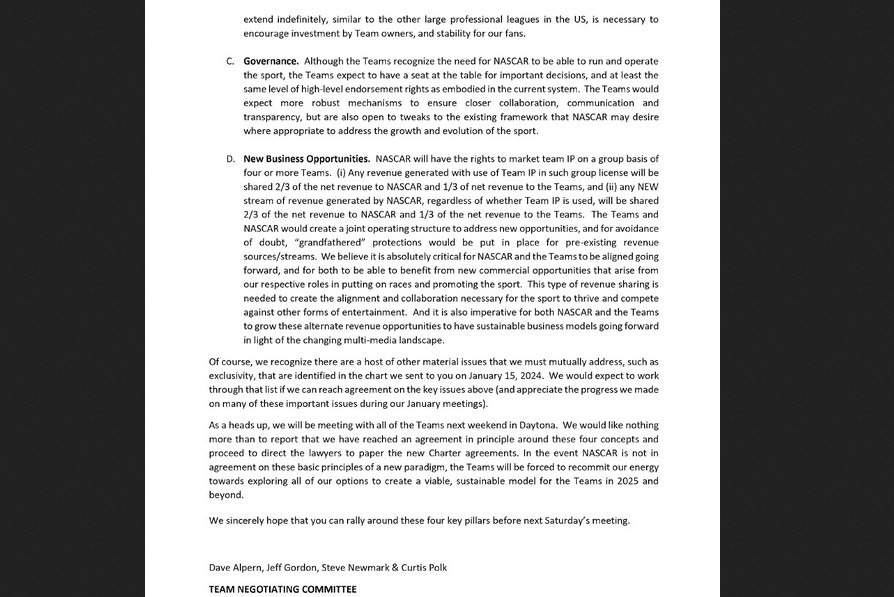

The genesis of this lawsuit lies in the refusal of 23XI Racing and Front Row Motorsports to sign the latest charter agreement extension proposed by NASCAR. This came after nearly three years of often contentious negotiations between NASCAR and the teams that operate at the sport’s pinnacle. The charter system itself is the foundational document that governs the business and competitive landscape of the Cup Series, outlining the relationship between NASCAR and its elite teams.

Related News :

- Talladega Sees Unprecedented Lead Changes, Nearing NASCAR Record

- Larson Crowned Champion as Hamlin Secures Runner-Up in Dramatic 2025 NASCAR Cup Series Finale

- Race Teams Charted Bold Independent Racing Futures Beyond NASCAR’s Reach, Unsealed Documents Reveal

- NASCAR prospect Connor Zilisch to Make LMDh Prototype Debut at Daytona Test

- NASCAR Kicks Off 2026 Short Track Development with Crucial Tire and Aerodynamic Testing

The extensive fact discovery process has unearthed a wealth of documentation and communications from these protracted negotiations. A significant portion of the back-and-forth reportedly revolved around financial terms, specifically the percentage of revenue that charter-holding teams would receive following the conclusion of NASCAR’s current broadcast rights agreements with entities like FOX, NBC, Turner Sports, and Amazon Prime. Beyond revenue sharing, teams also sought to establish their charters as permanent, saleable assets, rather than agreements requiring renegotiation every seven years. Disputes also arose concerning NASCAR’s rights to utilize a team’s intellectual property and broader governance matters.

Ultimately, 13 of the 15 Cup Series organizations agreed to the charter agreement for the 2025-2031 period. NASCAR states this new agreement represents a 62 percent increase in revenue distributed to teams compared to the previous iteration, attributing this growth to new revenue streams generated from recent broadcast deals. Furthermore, NASCAR asserts that the current agreement shifted $50 million in revenue previously allocated to tracks to teams, a change from the 2016 charter document. Conversely, the plaintiffs argue that the overall increase amounts to a more modest 3-4 percent per year over the 15-year span from 2016 to 2031. It was following this impasse that 23XI and Front Row initiated legal proceedings.

NASCAR’s primary defense hinges on the assertion that 23XI and Front Row have not acted in good faith, characterizing their antitrust claim as a tactic to leverage negotiations through litigation. Lead attorney Christopher Yates has repeatedly argued that NASCAR’s actions have not restrained competition, but rather have demonstrably increased the enterprise value of owning Cup Series teams since the charter system’s inception in 2016. NASCAR points to the significant appreciation in the value of a single charter, which has reportedly risen from approximately $1 million to upwards of $50 million in recent market transactions. This valuation, NASCAR contends, is a direct result of strategic leadership that has enhanced the worth of charter memberships across two agreement cycles. The organization will also likely argue that exclusivity and non-compete clauses are standard and legal business practices within professional sports, essential for effective marketing and fan engagement without creating market confusion.

A key element of NASCAR’s defense is the argument that both 23XI and Front Row have previously agreed to terms they now challenge as anti-competitive. Both teams have acquired charters from other organizations in the past decade without raising antitrust concerns until the conclusion of the recent negotiations. NASCAR’s legal team intends to demonstrate that these teams have, on multiple occasions, entered into agreements containing the very clauses they now deem illegal, suggesting a selective application of their legal objections.

The path to trial has been marked by multiple attempts at resolution. Court-ordered settlement mediation sessions were held over the summer, including a meeting in New York City on August 5, 2025, facilitated by former NBA Chief Legal Officer Jeffrey. This session reportedly lasted only an hour and yielded no significant progress. Subsequently, NASCAR petitioned for a court-mandated mediation, which Judge Bell granted. This two-day session in October, described by Judge Bell as conducted "in good faith," also concluded without an agreement, reportedly faltering over the allocation of legal fees, though some consensus on charter permanency was reportedly reached.

The upcoming trial is slated to run for 10 days, spanning two consecutive weeks, with jury selection commencing on Monday. The proceedings will not be broadcast, and information will be disseminated through hand-written notes by attendees. Both parties have submitted extensive exhibit lists – 23XI and Front Row with 858, and NASCAR with 961 – and a comprehensive, though not publicly disclosed, witness list likely includes team owners, executives, and industry experts.

A unanimous decision from the six-person jury will be required for Judge Bell to issue a remedy. The burden of proof rests with 23XI and Front Row, who must convince the jury of a "preponderance of the evidence," meaning their claims are more likely than not to be true. The plaintiffs are seeking over $300 million in damages, with the jury determining the final amount, limited to a four-year lookback period. Judge Bell possesses the authority to potentially triple damages as a punitive measure and to implement a range of antitrust remedies. These could include compelling NASCAR to divest itself of certain tracks, abolish the single-source supplier system for the current car, eliminate exclusivity clauses, or fundamentally alter the charter system.

An underreported aspect of a potential 23XI and Front Row victory is that it does not automatically guarantee the return of their charters. Due to a preliminary injunction appeals decision earlier this year, both teams lost their chartered status. Their damage claims include the financial impact of this loss. Legal experts suggest it is unlikely that a court would award significant monetary damages while also forcing NASCAR to reinstate charters, given NASCAR’s argument that it cannot be compelled to do business with entities it chooses not to.

Judge Bell has indicated an openness to deeming the current structure of the charter system illegal, a sentiment echoed by the 13 non-party teams who submitted affidavits urging a settlement to protect their investments. Should NASCAR prevail, 23XI and Front Row could face financial ruin without charters and potentially be excluded from the Cup Series by the end of the 2026 season. NASCAR would then be free to sell the suspended charters, provided Judge Bell does not rule the system itself unlawful. The organization had reportedly received offers for these six charters prior to the trial.

Regardless of the outcome in the federal district court, the case is widely expected to be appealed to the Fourth District Court of Appeals in Richmond, Virginia, with the possibility of further appeal to the United States Supreme Court. This legal saga also includes a dismissed countersuit filed by NASCAR against 23XI, Front Row, and Denny Hamlin, accusing them of anti-competitive cartel behavior. While dismissed at the summary judgment stage, NASCAR has indicated its intent to appeal this decision as well. Ultimately, the ongoing trial represents not an end, but a critical juncture in a complex legal and business dispute that has the potential to fundamentally reshape the landscape of NASCAR for years to come, unless a settlement is reached at any point in the proceedings.

💬 Tinggalkan Komentar dengan Facebook

Author Profile

Latest entries

Nascar CupFebruary 22, 2026Fifty Years On: The Improbable, Crawling Triumph of David Pearson at Daytona

Nascar CupFebruary 22, 2026Fifty Years On: The Improbable, Crawling Triumph of David Pearson at Daytona Nascar CupFebruary 22, 2026Joey Logano Dominates Duel 1, Casey Mears Secures Daytona 500 Berth in Dramatic Overtime Finish

Nascar CupFebruary 22, 2026Joey Logano Dominates Duel 1, Casey Mears Secures Daytona 500 Berth in Dramatic Overtime Finish Nascar CupFebruary 22, 2026Heartbreak for Anthony Alfredo as Daytona 500 Dream Ends with Disqualification

Nascar CupFebruary 22, 2026Heartbreak for Anthony Alfredo as Daytona 500 Dream Ends with Disqualification Nascar CupFebruary 22, 2026Why the 2027 Daytona 500 is the end of a road for Jimmie Johnson

Nascar CupFebruary 22, 2026Why the 2027 Daytona 500 is the end of a road for Jimmie Johnson