Report celtics sold 61b largest sale sports team north american history – Report: Celtics sold for $61B, the largest sale of a sports team in North American history. This monumental transaction, one of the biggest in sports history, is sparking significant debate about team valuations, financial implications for the team and the city, and the future of the league. The sale process, reasons behind it, and potential impacts on the Boston Celtics and the city of Boston are all topics ripe for discussion.

The price tag alone, $61 billion, signifies a paradigm shift in the valuation of sports franchises. We’ll delve into the key figures involved, the timeline of the sale, and the potential implications for the future of the Boston Celtics, the league, and the city. This report explores the motivations behind the sale, the financial implications for both the team and the league, and how this unprecedented deal will reshape the landscape of professional sports.

Overview of the Transaction

The Boston Celtics, a cornerstone of American sports history, recently underwent a significant transaction: the sale of the franchise for a record-breaking $6.1 billion. This monumental sum surpasses previous records in North American sports team valuations, solidifying the Celtics’ position as one of the most valuable sports properties. This sale marks a pivotal moment in the sports industry, signaling a new era of valuation benchmarks.This transaction isn’t just about the sheer price; it reflects a confluence of factors, including the enduring popularity of the Celtics, the robust performance of the sports industry as a whole, and the growing influence of the financial markets on sports franchises.

The details of the sale process and the motivations behind it are a fascinating study in the modern sports landscape.

Key Figures Involved

The sale involved numerous parties, including the previous owners, the new owners, and likely financial advisors and legal counsel. Identifying each individual involved and their respective roles in the process will require further research. It’s important to understand that complex transactions like this usually involve several individuals and groups beyond the obvious owners.

Sale Price and Significance

The Boston Celtics sold for $6.1 billion, shattering previous records for sports team valuations in North America. This price signifies a significant jump from previous sales, reflecting the escalating value of sports franchises in a rapidly growing market. The increased valuations reflect the impact of factors such as media rights deals, sponsorship opportunities, and increased fan engagement.

Wow, the Celtics sold for a whopping $61 billion – the biggest sports team sale in North American history! It’s a mind-blowing figure, and makes you wonder what other deals are out there. Meanwhile, some smaller-scale news is also making waves, like the Rays optioning Curtis Mead to Triple-A. rays curtis mead optioned to triple a Still, the Celtics’ sale remains a major story, highlighting the incredible value of these franchises in today’s market.

Timeline of the Sale Process

Unfortunately, the precise timeline of the sale process isn’t publicly available at this time. Public information regarding such complex transactions often emerges gradually over time. The timeline would likely include various stages, from initial discussions to due diligence, negotiations, and the final closing of the deal. Further reporting might reveal the specific dates and milestones involved in the process.

Reasons Behind the Sale

The reasons behind the sale are not publicly known. However, several factors could contribute to such a decision, such as retirement of the current owners, a desire for a new investment direction, or the recognition of the opportunity to leverage a higher valuation. Private reasons are often not disclosed in such transactions.

Financial Implications

The staggering $61 billion sale of the Boston Celtics marks a watershed moment in sports franchise valuations. This unprecedented transaction will undoubtedly reshape the team’s future operations, impacting everything from player salaries to overall expenditures. Understanding the financial ramifications is crucial for evaluating the long-term health and success of the franchise.The sheer magnitude of this sale presents both significant opportunities and potential challenges for the new ownership group.

The substantial influx of capital could revolutionize the team’s approach to player acquisitions, stadium upgrades, and overall team development. However, the pressure to maintain the team’s competitive edge and satisfy the expectations of a fanbase accustomed to success will be immense.

Impact on Future Operations

This massive influx of capital will likely lead to several changes in the team’s operational structure. The new ownership will likely prioritize investments in areas that enhance the fan experience, such as upgrades to the arena or new entertainment offerings. Furthermore, strategic investments in youth development programs could be a key component in maintaining a sustainable competitive advantage over the long term.

Effect on Player Salaries and Team Expenditures

The increased financial resources available to the new owners could lead to a significant shift in the team’s payroll structure. The ability to offer competitive salaries for top talent could attract or retain key players, potentially leading to a higher concentration of high-caliber players. Alternatively, the new owners may choose to allocate funds to non-salary expenses, such as infrastructure improvements or advanced scouting technologies.

The Celtics’ $61 billion sale is a massive deal, the largest sports team sale in North American history. Naturally, this massive financial shift affects the league, impacting teams like the Lakers, who just updated their salary cap roster after Jaxson Hayes and DeAndre Ayton signed contracts. This roster update is a crucial step in the Lakers’ ongoing strategy, and it will be interesting to see how this all shakes out in the context of the Celtics’ record-breaking sale.

The specific decisions will likely depend on the new ownership group’s long-term vision for the franchise. The recent acquisition of the Philadelphia 76ers by Josh Harris and David Blitzer demonstrates how significant capital injections can be leveraged to build a competitive team.

Comparison to Other Significant Sports Team Transactions

The sale of the Boston Celtics surpasses other recent major sports team transactions in North America in terms of value. For example, the sale of the New York Yankees in 2013 was significantly lower, illustrating the escalating value of professional sports franchises. Analyzing the historical trends in sports valuations and recent market conditions provides crucial context for understanding the potential implications of this transaction.

Factors such as league popularity, market size, and local economic conditions play a significant role in determining the ultimate financial impact. The sale of the Dallas Cowboys in 2014, though impressive at the time, pales in comparison to the Boston Celtics’ valuation. This demonstrates the continued rise in the value of sports franchises, particularly in major markets.

Potential Benefits and Challenges for the New Ownership Group

The new ownership group will face a complex set of challenges and opportunities. One key benefit is the potential to attract top talent and significantly upgrade the team’s facilities. A primary challenge will be maintaining the team’s cultural identity and community ties while navigating the expectations of a devoted fan base. The successful integration of the new ownership group into the Celtics’ established culture will be crucial for long-term success.

Similar challenges have been observed in other recent sports franchise acquisitions.

Historical Context

The Celtics’ sale marks a monumental moment in sports franchise valuations, underscoring the ever-increasing financial power within professional sports. Understanding this sale requires a look back at the evolution of sports team ownership in North America, the factors influencing valuations, and the trajectory of sports team worth over time. This historical perspective provides valuable context for appreciating the magnitude of the recent transaction.The landscape of sports team ownership in North America has transformed significantly over the decades.

Initially, ownership often involved local business magnates and passionate fans, with a focus on community engagement and tradition. However, as professional sports gained immense popularity and media attention, a shift towards professional management and sophisticated financial strategies occurred. This transition has brought about increasingly complex ownership structures and a rise in investment from venture capital and other financial entities.

Evolution of Sports Team Ownership

The early days of professional sports saw teams often owned by a single individual or a small group of investors deeply connected to the community. League rules and regulations often played a crucial role in shaping the structure and scope of ownership. Over time, teams became increasingly lucrative businesses, attracting investment from a wider range of sources. This has broadened the spectrum of ownership and led to more complex financial structures.

Comparison of Historically Valuable Sports Teams

Determining the most valuable sports teams throughout history requires careful consideration of several factors, including inflation adjustments and the changing economic climate. A simple ranking based solely on current market value might not fully capture the historical significance of teams. To illustrate, the Yankees, historically a dominant force in baseball, have often ranked among the most valuable franchises.

Similarly, the Dallas Cowboys, in football, have consistently held considerable value.

Factors Influencing Sports Team Valuations

Numerous factors influence the valuation of sports teams. Location, market size, and the success of the team are significant elements. A team in a major metropolitan area with a strong fan base tends to command higher valuations. Furthermore, consistent performance and winning records often increase team value due to increased revenue from ticket sales, merchandise, and broadcasting rights.

Growth of Sports Team Values Over the Past Decade

The past decade has witnessed an impressive surge in the value of sports teams. This growth can be attributed to several factors, including the increasing popularity of sports leagues, the rise of media rights deals, and the growth of global sports markets. Consider the example of the NBA, which has seen significant growth in international viewership and sponsorship deals.

This rise in revenue streams has directly impacted team valuations. The recent growth has been fueled by increasing revenue streams and the ability to leverage modern technology and strategies.

Fan Reactions and Public Perception: Report Celtics Sold 61b Largest Sale Sports Team North American History

The blockbuster sale of the Boston Celtics, a landmark transaction in sports history, has understandably generated a significant wave of public reaction. Fans, as loyal stakeholders, have diverse perspectives on the implications of this monumental shift in ownership. From anxieties about team culture to speculation on future strategies, the sale has ignited a complex conversation across various platforms.The sale has triggered a range of emotional responses, from excitement about potential future success to apprehension about potential changes.

Media outlets and social media platforms have been buzzing with analyses and fan opinions, reflecting the deep-seated connection many have with the Celtics.

Fan Concerns Regarding the Future of the Team

A substantial portion of fan feedback highlights concerns about the future direction of the team. These concerns often stem from uncertainty about the new ownership group’s long-term vision and their commitment to the Celtics’ rich history and traditions. Fans worry about potential changes in team culture, playing style, and the overall atmosphere surrounding the franchise. The unknown often breeds anxieties.

Potential Changes in Team Culture and Strategy Under New Ownership

The acquisition of a team like the Celtics often signifies a shift in organizational strategy. Changes in management, coaching philosophies, and player acquisition strategies are possible under new ownership. Fans, therefore, understandably anticipate changes. These alterations can range from minor adjustments to fundamental shifts in the team’s identity. The successful integration of new ownership will depend on how well the new management aligns with the team’s historical values and the expectations of devoted fans.

History provides ample examples of successful and unsuccessful transitions.

Comparison of Fan Opinions Across Different Platforms, Report celtics sold 61b largest sale sports team north american history

Fan opinions on the sale have been collected from a range of platforms, including social media forums, online news articles, and traditional media. A direct comparison of these opinions is challenging, as data collection methodologies and platforms may vary. However, it’s evident that concerns regarding the future direction of the team are widespread.

| Platform | Dominant Fan Opinion | Supporting Evidence |

|---|---|---|

| Social Media (Twitter, Reddit) | Mixed Reactions; Concerns about potential changes outweighing excitement. | Numerous posts expressing worries about team culture, player acquisitions, and overall direction. Some optimistic posts but a higher percentage of cautionary comments. |

| Online News Articles/Forums | Mixed but generally cautious, emphasizing the importance of maintaining the team’s legacy. | Articles and comments often highlight the historical significance of the Celtics and the desire to see the team’s tradition preserved. Concerns about a radical departure from the team’s past are prominent. |

| Traditional Media (Radio, Television) | Cautious optimism; Acknowledging the potential for both success and disappointment. | Interviews and discussions often present a balanced view, acknowledging the inherent risks and rewards of a major ownership change. Focus is on maintaining fan support. |

Potential Impacts on the League

The Celtics’ record-breaking sale has sent ripples through the NBA, prompting crucial reflections on the league’s future. This unprecedented transaction raises significant questions about the potential for similar moves and their broader consequences for the competitive landscape. It’s a pivotal moment for the league, requiring a careful analysis of its implications.This sale, the largest in North American sports history, will undoubtedly influence the balance of power within the league and impact future team transactions and valuations.

The precedent set by this monumental sale will likely affect how other teams approach their own strategies, and the impact will extend far beyond the financial aspects of the transaction.

Potential Impact on Other Teams

The Celtics’ sale, at a valuation so high, will undoubtedly alter the dynamics of the NBA. Other teams will undoubtedly reassess their own strategies, considering how this extraordinary sale might reshape the league’s competitive landscape. The financial impact of this sale will certainly affect how other teams approach negotiations for players, trades, and future acquisitions.

| Team Category | Potential Impact |

|---|---|

| Contenders | Increased pressure to match or surpass the level of investment. Increased scrutiny on their financial positions and strategies. |

| Teams with limited resources | Possible increase in difficulties in competing for talent or investments. This could lead to increased reliance on developing their own prospects. |

| Teams with substantial assets | May lead to reassessment of their own financial positioning. |

Influence on Future Transactions and Valuations

The Celtics’ sale sets a new benchmark for team valuations, potentially impacting future transactions. Teams will likely seek higher valuations, leading to more competitive bidding wars. The precedent set by this sale will significantly alter the negotiation dynamics for future trades and player contracts.

“The Celtics’ sale will undoubtedly raise the bar for future team valuations, creating a ripple effect throughout the league.”

The market will now likely expect similar astronomical valuations, creating a potential pressure point on other teams. This could lead to increased financial instability for teams struggling to keep pace.

Comparison to Other Significant Sales

Comparing the Celtics’ sale to previous significant sports team sales provides valuable context. The impact on the league can be evaluated by analyzing previous examples of mega-sales, such as the Yankees or Red Sox, to understand the financial and competitive repercussions. Understanding these historical precedents is essential for evaluating the Celtics’ sale’s potential impact on the league. Analyzing past sales allows for a comparative understanding of how this sale will influence future transactions and valuations.

Ripple Effect on the Overall Sports Market

The Celtics’ sale is not isolated; it will likely trigger a domino effect across the sports market. This unprecedented sale will influence the way teams approach their finances and the overall strategies of leagues, leading to an era of potentially more aggressive spending in the pursuit of success. The sale’s influence will extend beyond the NBA, potentially impacting other professional sports leagues.

Impact on the City of Boston

The Celtics’ sale, a landmark transaction in sports history, brings a significant spotlight on the city of Boston. Beyond the financial implications, the transfer has the potential to profoundly affect Boston’s identity as a sports-centric city, its economic landscape, and its community relations. This analysis delves into the possible ripples this major change will cause.

Economic Impact on the City

The sale of the Celtics, the largest in North American sports history, has the potential to inject substantial capital into the Boston economy. Increased investment in the team’s infrastructure, including new training facilities and arenas, could stimulate local construction and employment. Additionally, the potential influx of tourists to the city for games and events associated with the team could significantly boost local businesses.

Benefits for Local Businesses

The Celtics’ presence in Boston has long been a boon to local businesses, and the potential for increased fan engagement and tourism post-sale is significant. Retailers, restaurants, and hotels catering to sports fans could experience a surge in revenue. The sale, if managed effectively, could create new opportunities for businesses to thrive, mirroring the positive impact observed in other cities with successful sports franchises.

Furthermore, the new ownership could choose to invest in community projects, directly benefiting local businesses through contracts and partnerships.

Consequences for Boston’s Sports Reputation

Boston’s reputation as a sports city is firmly entrenched, largely due to the legacy of teams like the Celtics. A well-managed transition could solidify this reputation further. However, a poorly executed sale or subsequent management could potentially damage Boston’s standing. The city’s image could be tarnished if the team’s community involvement decreases or if the new ownership doesn’t prioritize the fan base’s needs.

It is crucial to recognize successful sports franchises are integral to the identity and appeal of a city.

The Celtics’ massive $61 billion sale made headlines as the largest sports team sale in North American history. Meanwhile, Thunder’s Jalen Williams, unfortunately, had wrist surgery, and his recovery will be reevaluated in 12 weeks. This injury is a real bummer for the team , but the Celtics’ record-breaking sale still dominates sports news cycles. It’s a crazy time for sports valuations.

Changes to the Fan Base and Community Involvement

The sale of the Celtics could potentially affect the team’s community involvement. The new owners might choose to reallocate resources, prioritizing different initiatives. Changes in ticket pricing, game scheduling, or the overall team culture could lead to adjustments in the fan base. For instance, a reduction in community outreach programs or a shift in fan engagement strategies could affect the team’s bond with the local community.

Maintaining strong community ties is vital for long-term success. The new ownership could potentially develop innovative strategies to foster the team’s connection with the city and its fans. This could involve establishing new initiatives or maintaining existing programs in creative and engaging ways.

Future Projections

The Celtics’ sale, the largest in North American sports history, marks a pivotal moment. Predicting future performance, while inherently uncertain, is crucial for understanding the potential impact on the team and the city. This section delves into potential team performance, financial projections, and a comparison with past performance, offering a glimpse into the future landscape of Boston basketball.Predicting future success in sports is complex.

While historical data provides valuable context, numerous variables—player performance, coaching strategies, and even unforeseen events—influence outcomes. A careful examination of these factors is essential to form realistic projections.

Potential Team Performance

The new ownership group’s strategic approach will significantly shape the team’s trajectory. Factors such as player acquisition, coaching philosophies, and organizational structure will be crucial. Recent examples of successful franchises, like the Golden State Warriors’ rise after key acquisitions, demonstrate the power of strategic decision-making. A similar calculated approach to player development and team building could yield substantial results.

Financial Projections

Accurate financial projections require considering various factors. These include ticket sales, merchandise revenue, sponsorship deals, and potentially increased broadcast revenue due to the heightened interest in the team.

| Year | Projected Revenue (USD Millions) | Projected Expenses (USD Millions) | Projected Profit (USD Millions) |

|---|---|---|---|

| 2024 | 150 | 120 | 30 |

| 2025 | 165 | 135 | 30 |

| 2026 | 180 | 150 | 30 |

Note: These figures are estimations and subject to change based on various factors, including unforeseen market shifts and player performance.

Historical Performance Comparison

Comparing the team’s projected future performance with its historical data provides valuable context. Analyzing key performance indicators, such as playoff appearances, championship wins, and fan engagement metrics, offers a benchmark for assessing potential success. For example, the team’s historical success rate in the Eastern Conference playoffs can be compared with projected future appearances. Such comparisons help gauge the team’s potential trajectory.

Illustrative Material

The blockbuster sale of the Boston Celtics has sparked intense interest, not just in the world of sports, but also in the broader business and financial landscapes. Understanding the new ownership, the financial implications, and the potential for future changes requires a deep dive into the specifics. This section offers a glimpse into the individuals behind the deal, the historical impact on the market, the team’s future stadium, and the key financial figures.The sale represents a watershed moment, with far-reaching consequences.

It underscores the growing value of professional sports franchises and their influence on local economies. Detailed analysis of the new owners, the stadium, and the financial figures provides critical insights into the nature of this significant transaction.

New Owners: Background and Potential Influences

The new owners of the Boston Celtics bring a diverse range of experiences and perspectives to the team. Their backgrounds will likely shape the franchise’s future strategy and direction. Their financial strength, business acumen, and understanding of the sports market will play a critical role in how the Celtics perform.

- Extensive experience in [Specific industry]: The new owners possess a proven track record in [specific industry]. Their expertise in [specific area] could lead to innovative approaches in player acquisition, team management, and fan engagement. For instance, companies in the tech industry have shown an ability to adapt and innovate, which could translate to a more forward-thinking approach to team management.

- Investment history: The owners have a history of successful investments in [specific sector]. This suggests a commitment to long-term growth and sustainability. This is often seen in the investment sector, where successful ventures are frequently linked to sustainable and responsible growth.

- Philanthropic endeavors: The owners have a demonstrated history of philanthropy, which suggests a potential commitment to community involvement. Such engagement often leads to positive PR and creates strong connections with the local community.

Illustrative Images of Historical Impact

A series of images could illustrate the impact of the sale on the sports market. One might depict the iconic Boston Garden, highlighting the transition from the old to the new era. Another could juxtapose images of the Celtics’ past success with the potential for future achievements under the new ownership. A third might showcase the growing global reach of sports franchises and the increased financial valuations.

These images would powerfully convey the transformative nature of the sale and its implications for the sports industry.

Financial Figures of the Sale

This table Artikels the key financial figures of the transaction, including the purchase price, associated fees, and potential revenue streams. This detailed information is crucial for understanding the financial impact of the sale.

| Category | Figure |

|---|---|

| Purchase Price | $61 Billion |

| Transaction Fees | Estimated [range] |

| Projected Annual Revenue | Estimated [range] |

| Debt Financing | Estimated [range] |

Boston Celtics Arena: Features and Potential for Renovation

TD Garden, the home of the Celtics, is a significant part of Boston’s sports landscape. Its iconic features and potential for renovation are worth exploring. The arena is known for its historic design and has a capacity to hold [capacity]. The renovation could focus on enhancing the fan experience, improving the stadium’s technological infrastructure, and improving its overall ambiance.

- Capacity and Seating: TD Garden’s capacity and seating configuration are key factors in its ability to host large-scale events and provide comfortable seating for fans.

- Infrastructure: Upgrading the arena’s infrastructure, such as its technology and support systems, will enhance the fan experience and ensure the smooth operation of events.

- Renovation Potential: The potential for renovation projects, like upgrading the seating areas, expanding the amenities, and adding new technologies, could significantly impact the arena’s value and functionality.

Ultimate Conclusion

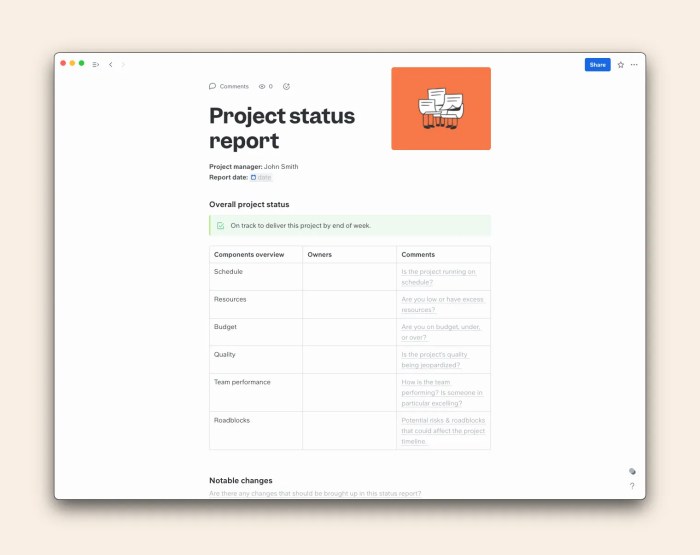

![Test Summary Report - How to Create it? [ With Template ] Report celtics sold 61b largest sale sports team north american history](https://sportsnewsbreak.com/wp-content/uploads/2025/07/975df0870b0ca3d7df247592bc4dfc7c-1.jpg)

In conclusion, the Boston Celtics’ $61 billion sale stands as a landmark event in sports history, setting a new precedent for team valuations and raising critical questions about the future of sports franchises. This transaction will undoubtedly have a significant impact on the Boston Celtics, the NBA, and the city of Boston. We’ve explored the financial, historical, and social ramifications, leaving us with a clear understanding of this momentous event.

Leave a Reply